estate tax exclusion amount sunset

As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple with portability. The estate of a New York State resident must file a New York State estate tax return if the following.

Create An Estate Plan Now To Take Advantage Of Big Tax Exemption

However the TCJA will sunset.

. Even if the BEA is lower that year As estate can still base its estate tax calculation on the higher 9. Its 1158 million for deaths occurring. The federal estate tax exemption is indexed for inflation so it increases periodically usually yearly.

However the TCJA will sunset. Unless your estate planning is. For 2022 the personal federal estate tax exemption amount is 1206 million.

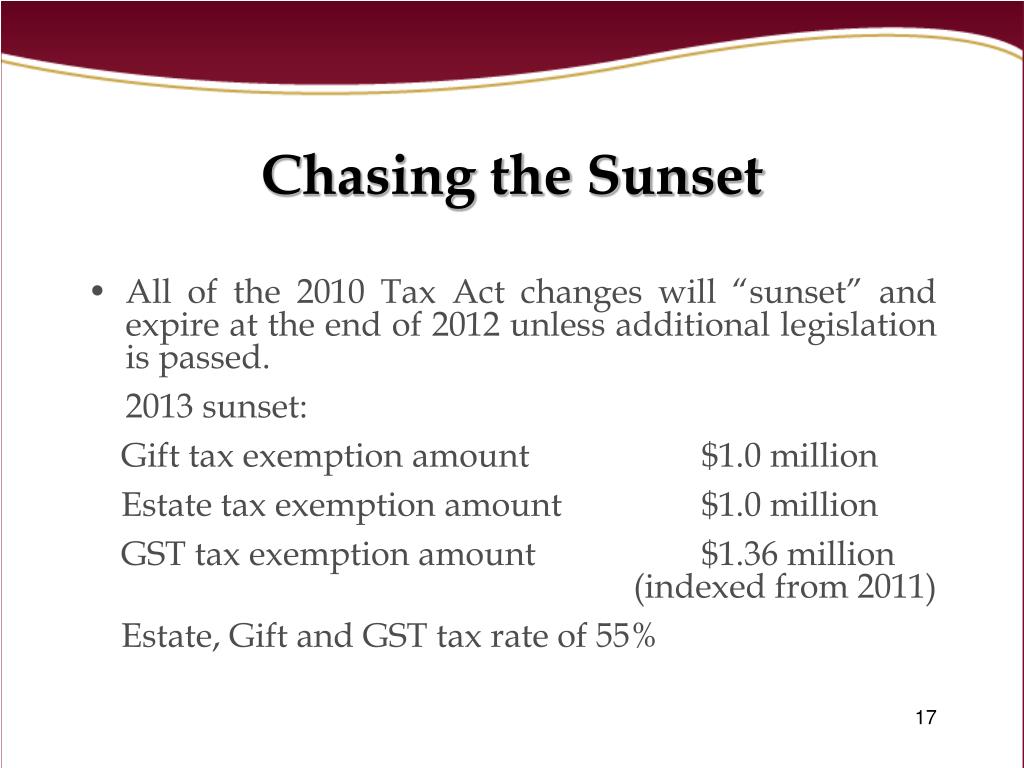

After that the exemption amount will drop back down to the prior laws 5 million cap. The Federal Estate Tax Exemption. Under the 2010 Tax Relief Act the lifetime estate and gift tax basic exclusion amount was 5000000 and this amount was indexed for inflation after 2011 and increased.

For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021. Basic exclusion amount BEA For dates of death. This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes.

A uses 9 million of the available BEA to reduce the gift tax to zero. After 2025 the exemption amount will sunset a fancy way of. Notably the TCJA provision that doubled the gift.

Before 2011 a much. However the favorable estate tax changes in the TCJA are currently. 2001 2501 and 2601 respectively but the lifetime estate and gift.

When the calendar turns to 2026 the estate tax provisions implemented by the Tax Cuts and Jobs Act TCJA are due to expire or sunset. This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes. However the favorable estate tax changes in the TCJA are currently scheduled to sunset after 2025 unless Congress takes further action.

In 2025 you both. The exempt increased from 117 million for. The current estate and gift tax exemption is scheduled to end on the last day of 2025.

Fast-forward to 2026 and the estate and gift tax exemption. The estate tax due would be zero. Even then only the value over the exemption.

A dies in 2026. The gross value of your estate must exceed the exemption amount for the year of your death before estate taxes will come due. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation.

As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple with portability. Fast-forward to 2026 and the estate and gift tax exemption. The Tax Cuts and Jobs Act TCJA of 2017 doubled the federal estate tax exemption but only for a limited number of years.

As a result of the current estate tax exemption amount 1206 million in 2022 many estates no longer need to be concerned with federal estate tax. Understanding the 2022 Estate Tax Exemption. The foundation of the federal estate gift and generation - skipping transfer GST tax framework was retained under Secs.

We arent sure what you will be living on between 2025 and the date of your death but at least no death tax will be payable.

Federal Estate And Gift Tax Exemption To Sunset In 2025 Are You Ready Adviceperiod

Farmers Ranchers Need Permanent Fix For Estate Tax Texas Farm Bureau

Change May Be On The Horizon For Estate And Gift Tax Exemptions

Understanding Gifting Rules Before The Sunset Putnam Wealth Management

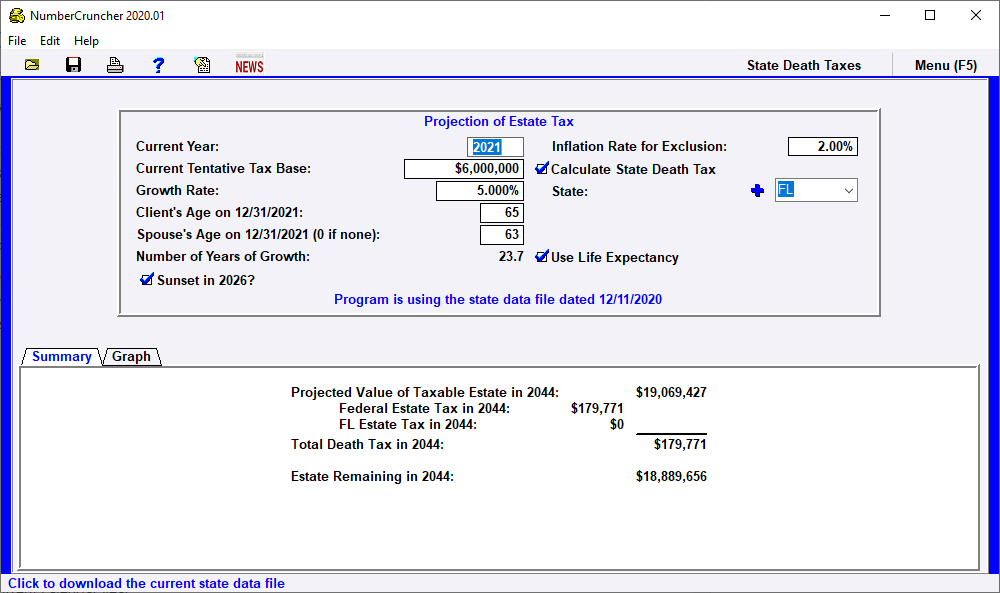

Project Projection Of Estate Tax Leimberg Leclair Lackner Inc

Gift Money Now Before Estate Tax Laws Sunset In 2025 Press Enterprise

The Federal Estate Tax Is Back Ppt Video Online Download

Estate Tax In The United States Wikipedia

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

Clinton County Auditor Estate Tax

Tax Rates Sunset In 2026 And Why That Matters Barber Financial Group

Tax Rates Sunset In 2026 And Why That Matters Barber Financial Group

Are You Prepared For An Estate Tax Sunset Trevor Lawson

The Federal Estate Tax Is Back Ppt Video Online Download

Ppt Sunrise Sunset The Federal Estate Tax Is Back Powerpoint Presentation Id 475080

Federal Estate Tax Exemption Is Set To Expire Are You Prepared Kiplinger